판도라 토토

저희 배트맨은 판도라 토토 협력으로 1억 원의 보증금을 확보하여, 회원님들이 안전하게 서비스를 이용하실 수 있도록 노력하고 있습니다. 이 보증금은 여러분이 안심하고 즐길 수 있도록 마련된 든든한 보안 장치입니다.

배트맨 전용 코드를 통해 가입한 회원님들께는 예기치 않은 상황이 발생하더라도 저희가 모든 책임을 지고 신속히 해결해드리며, 손해는 전액 보증금으로 보상해드릴 것을 약속드립니다. 회원님의 신뢰를 소중히 여기며 최선을 다하고 있습니다.

판도라 토토는 사용자의 안전을 최우선 과제로 삼아 시스템을 꾸준히 개선하고 강화해 오고 있습니다. 다채로운 이벤트와 혜택을 마련하여, 게임을 더 즐겁게 경험할 수 있는 환경을 제공하고자 최선을 다하고 있습니다. 이러한 노력은 회원님들이 걱정 없이 게임을 즐길 수 있도록 한 발 앞서 준비된 것입니다.

배트맨은 대한민국에서 가장 신뢰받는 검증 기관으로, 엄격한 기준을 거쳐 판도라 토토의 안전성을 철저히 검증하였습니다. 그 결과, 저희는 판도라 토토를 자신 있게 추천드리며, 함께 협력하여 더욱 신뢰할 수 있는 서비스를 제공하고 있습니다.

판도라 토토는 공정성과 투명성을 중시하는 운영 방침으로 회원님의 신뢰를 쌓아왔으며, 배트맨의 검증과 보증 시스템으로 이 신뢰를 더욱 강화하고 있습니다. 저희 배트맨은 회원님들이 안심하고 게임을 즐기실 수 있도록 지속적으로 노력하며, 최상의 서비스를 제공하기 위해 항상 최선을 다하겠습니다.

배트맨 전용 코드를 통해 판도라토토의 안전하고 신뢰할 수 있는 서비스를 경험해보세요. 저희는 언제나 회원님의 만족과 안전을 최우선으로 생각하며, 곁에서 든든하게 지원하겠습니다. 감사합니다.

가입코드 : 3113

판도라토토 최신 도메인 주소 바로가기

판도라 토토 도메인 가입코드 혜택

신규가입 40%

무한매충 15%

돌발충전 20%

입플 5+3 10+5 50+20 100+35 200+70

환전 제한 시간 없음

모든 은행 가입 가능

페이백 5%

가입코드 : 3113

판도라토토 주소 바로가기

판도라 토토의 장점 & 특징 목록

판도라 토토는 국내 최고의 배팅 검증기업인 배트맨에 의해 신뢰성과 안전성을 인정받아 까다로운 인증 과정을 거친 검증된 사이트입니다. 배트맨은 고유한 시스템을 통해 철저하게 검토를 진행하며, 이 사이트의 자금 운용 능력과 운영의 안정성을 다각도로 확인해왔습니다. 이러한 과정은 사용자가 더 안전하고 신뢰할 수 있는 배팅 환경을 누릴 수 있도록 만들어졌으며, 불미스러운 사고를 사전에 방지하기 위한 노력의 일환입니다.

특히, 판도라 토토는 다양한 은행 거래 옵션을 지원해 사용자 편의성을 극대화했습니다. 이 시스템 덕분에 사용자는 자신이 편리한 은행을 통해 자금을 쉽게 입출금할 수 있으며, 모든 금융 거래가 빠르고 원활하게 이루어질 수 있도록 보장합니다. 이는 사용자에게 폭넓은 금융 선택지를 제공하여 편리한 이용 경험을 가능하게 하고 있습니다.

판도라 토토는 이용자의 만족도를 높이기 위해 여러 가지 흥미로운 이벤트를 지속적으로 기획하고 있습니다. 이 이벤트들은 새로운 즐거움을 제공할 뿐만 아니라 추가적인 혜택을 통해 사용자의 배팅 경험을 더욱 풍부하게 만듭니다. 또한, 각종 프로모션과 보너스 혜택을 통해 고객의 만족도를 한층 높이고자 노력하고 있습니다. 이러한 다양한 이벤트는 고객들에게 꾸준한 흥미를 유발하여 더 나은 배팅 경험을 제공하고, 사이트의 질적 가치를 한층 더 높이는 데 기여하고 있습니다.

판도라 토토의 고객센터는 항상 열려 있으며, 이용자의 모든 문의에 대해 친절하고 정확한 응대를 약속드립니다. 사용자가 궁금한 점이나 어려움을 느낄 때 언제든지 연락할 수 있으며, 전문 상담팀이 빠르고 효과적으로 문제를 해결할 수 있도록 도와드립니다. 모든 고객의 질문과 요청을 세심하게 듣고, 가능한 한 최적의 해결책을 제시함으로써 최상의 고객 경험을 제공하고자 노력합니다.

앞으로도 판도라 토토를 이용해 주시는 고객님들께 감사의 마음을 전하며, 안전하고 만족스러운 배팅 경험을 위해 더욱 정진하겠습니다.

가입코드 : 3113

판도라토토 도메인 주소 바로가기

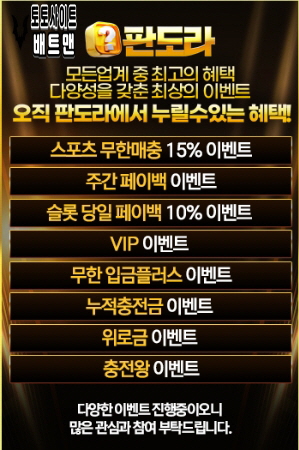

판도라 토토 대표 추천 이벤트

생일 이벤트

위로금 이벤트

슬롯당일 페이백 이벤트

누적충전 이벤트

첫충 & 매충 이벤트

등급 UP이벤트

맥모닝 이벤트

간식 & 야식 이벤트

미니게임 이벤트

레벨별 콤프 이벤트

지인추천 이벤트

돌발 이벤트

복귀자 이벤트

롤링왕 이벤트

다폴더 이벤트

월급날 이벤트

충전 환전 지연 이벤트

리뷰 작성 이벤트

텔레그램 채널방 이벤트

신규가입 첫충전 이벤트

슬롯첫충 & 매충 이벤트

낙첨 뽀찌 이벤트

3, 6, 9 이벤트

연속 출석 이벤트

국위선양 코리안 리거 득점 이벤트

가입코드 : 3113

판도라토토 최신 주소 바로가기

판도라 토토 진행하는 게임 종류

가상게임

크라운

토큰게임

엔트리

로투스

MGM

스포츠

네임드

스페셜

실시간

슈퍼게임

아시아 게이밍

플레이테크

타이산

모티베이션

WM카지노

마이크로 게이밍

비보게이밍

에볼루션 게이밍

벳게임즈

보타카지노

스카이윈드

프라그마틱 플레이

드림게이밍

두원카지노